TCS ON INTERNATIONAL CREDIT CARD PAYMENTS

Tax Collected at Sources (TCS) Under the Income Tax Act, 1961

Sec 206C (1G) was inserted by Finance Act, 2020 w.e.f. 01-10-2020 to enable Tax Collection at Source (TCS) by an Authorised Dealer (Banks, Forex dealer, Money changer etc.) on foreign remittance made under the Liberalised Remittance Scheme (LRS) under Foreign Exchange Management Act, 1999 (FEMA). In addition, the seller of overseas tour program was also required to collect tax at source from the buyer of such package. The rate for collection of TCS as introduced was @5%. The remittances made under LRS exceeding INR 7 Lacs in a financial year were subject to TCS where the purpose was other than a purchase of overseas tour program.

Finance Act 2023 (FA 2023), brought in various amendments to this situation with respect to remittances made outside India inter alia, increased the rate of TCS from 5% to 20% for remittance under LRS as well as for purchase of overseas tour program package and removed the threshold of Rs 7 Lacs for triggering TCS on LRS. The exception carved out was in respect of remittance made for education or medical purpose. These amendments were to take effect from 1st July 2023. Further, on 24-03-2023 when the finance minister tabled the budget 2023, in respect of LRS it was mentioned that ‘it has come to consideration that payments for foreign tours through credit cards are not being captured under the Liberalised Remittance Scheme (LRS) and they escape tax collection at source. Hence the Reserve Bank of India is being requested to look into this with a view to bring credit card payments for foreign tours within the ambit of LRS and tax collection at source thereon.’

Liberalised Remittance Scheme (LRS) under FEMA, 1999

Under the Liberalised Remittance Scheme (introduced in February 2004), all resident individuals, including minors, are allowed to freely remit up to USD 2,50,000 per financial year (April – March) for any permissible current or capital account transaction or a combination of both. Resident individuals can avail of foreign exchange facility for the purposes mentioned in Para 1 of Schedule III of the extant FEM (Current Account Transactions) Rules 2000, within the limit of USD 2,50,000 only. In case of remitter being a minor, the LRS declaration form must be countersigned by the minor’s natural guardian. The Scheme is not available to corporates, partnership firms, HUF, Trusts etc. The Rule 7 of the said Rules provided that the payment made by a person by International Credit Cards towards meeting expenses while such person is outside India will not be counted as drawal of foreign exchange towards LRS limit.

Amendments under Finance Act, 2023 & FEMA w.r.t to Remittances made outside India

1. 16-05-2023- The FEM (Current Account Transactions) Rules were amended to delete the Rule 7 vide notification dated 16-05-23 to remove the differential treatment for credit cards vis a vis other mode of drawal of foreign exchange under LRS.

2. 19-05-2023 -A press release was issued to clarify that to avoid any procedural ambiguity any payments by an individual using their international Debit or Credit cards upto Rs. 7 Lacs per financial year will be excluded from the LRS limits and hence, will not attract any TCS.

3. 19-05-2023- A press release compiling 7- FAQ’s regarding inclusion of international Credit Cards under LRS were released in line with amendments introduced vide Finance Act 2023 proposed to be applicable from 01-07-2023.

4. 28-06-2023- Press Release restores threshold of Rs. 7 Lacs and TCS rates before FA 2023 stating that government gives more time for implementation of revised TCS rates for inclusion of credit card payments in LRS.

5. 30-06-2023- Circular No. 10 was issued to remove difficulty in implementation of changes relating to TCS on LRS and on purchase of overseas tour package.

6. 30-06-2023- Rule 7 on Use of International Credit Cards Outside India was restored to FEM (Current Account Transactions) Rules vide notification dated 30-06-2023 with retrospective effect from 16-052023 and guidelines were issued in 8-question and answer form.

Key Highlights of Circular No. 10 of 2023 w.r.t to TCS on Remittances made outside India

• It was clarified that no TCS shall be applicable on expenditure through international credit card while being overseas.

• Increased TCS rates to apply from 1st October, 2023 - The increase in TCS rates; which were to come into effect from 1st July, 2023 shall now come into effect from 1st October, 2023.

• Threshold of Rs. 7 Lacs per financial year per individual in clause (i) of sub-section (1G) of section 206C shall be restored for TCS on all categories of LRS payments (except purchase of overseas tour programs), through all modes of payment, regardless of the purpose. Thus, for first INR 7 Lacs remittance under LRS there shall be no TCS (5% in case purchase of overseas tour programs).

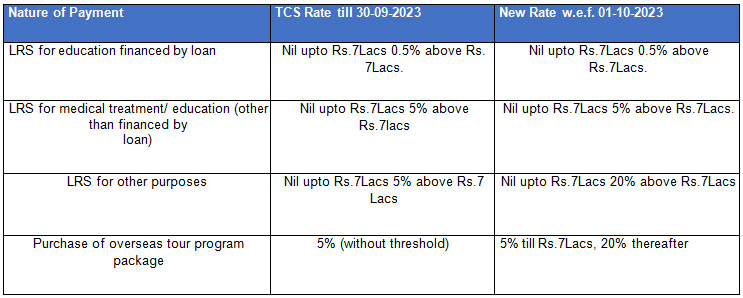

• Tabular representation of TCS rates up to 30-09-23 and w.e.f. 01-10-2023 is as follows:

• It was clarified that the threshold of Rs.7 Lacs is qua remitter and cumulative. It would apply on first Rs.7 Lacs remittance made during the financial year. Any remittance above the first 7 Lacs will be subject to TCS as per the purpose.

• Remitter before making LRS would be required to provide an undertaking in respect of overall LRS limit consumed in a financial year upto date.

• It is clarified that purchase of only international travel ticket or purchase of only hotel accommodation, by in itself is not covered within the definition of 'overseas tour program package'. To qualify as 'overseas tour program package', the package should include at least two of the followings: —

- (i) International travel ticket

- (ii) Hotel accommodation (with or without food)/boarding/lodging

- (iii) Any other expenditure of similar nature or in relation thereto

• Discussion on various codes to be used for different purpose under LRS

International Credit Cards in India

International credit cards in India are credit cards issued by banks that are affiliated with major international card networks like Visa, Mastercard, American Express, or Diners Club. These cards allow users to make purchases both domestically and internationally, as well as withdraw cash from ATMs worldwide, provided the card is accepted by the merchant or ATM.

Points to Ponder

As per the Circular No. 10 of 2023 the authorized dealer banks are not required to collect TCS on international credit card expenses while abroad upto 30-09-2023. However, any LRS transactions through international credit card from India will be subject to TCS. In absence of the mechanism to provide for that who will be responsible for TCS on such remittance?

It is important to note that press release dated 19-05-23 stated that to avoid any procedural ambiguity, any payments by an individual using their international Debit or Credit cards upto Rs.7 Lacs per financial year will be excluded from the LRS limits and hence, will not attract any TCS. Existing beneficial TCS treatment for education and health payments will also continue. However, Question 4 of the guidelines provided vide CBDT Circular No. 10 of 2023 states that the threshold of Rs.7 Lacs for LRS is combined threshold for applicability of the TCS on LRS irrespective of the purpose of the remittance. A combined reading of the press release and CBDT circular No. 10 may leave the remitter in a fix!

Conclusion

Resident Individual looking to remit the funds abroad should be extremely cautious on computing the LRS limit for the financial year. Any transaction of large or small value (Current or Capital) if incurred under LRS may be counted for the purpose of computing LRS limit under FEMA irrespective of the TCS treatment under ITA. Further in FEMA transactions incurred using international credit card except for meeting expenses abroad were always includible as a part of LRS limit.

Any bonafide mistake while making a wrong declaration may result in the remitter being treated as “assessee in default” under the ITA. Undertakings which are required to be signed by the remitter should be verified thoroughly. Any expenses incurred on behalf of the company should be clearly established and identified to have the same excluded from the individual LRS limits.

It is recommended that the laws in respect of computing LRS limits should be aligned under FEMA and ITA. The procedural difficulties while bringing the international credit card payments should be resolved without putting additional documentation pressure on the remitter. Further, any bonafide mistake of an honest ‘taxpayer’ who has paid all the taxes due on the income should not be treated as “assessee in default” by any incorrect declaration in the undertaking.